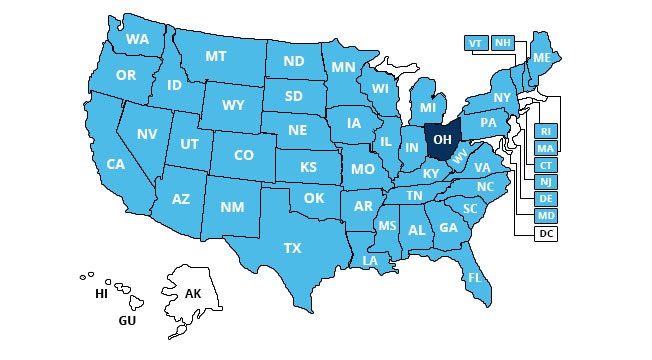

How To Get Ifta Sticker In Ohio

Fill it out the select the renew box. Once the SCDMVs Motor Carrier Services receives your completed Application for International Fuel Tax Agreement Credentials SCDMV Form IFTA-1 your IFTA license and decals will be issued.

Ifta Decal Renewal Application Fill Out And Sign Printable Pdf Template Signnow

You should speak to the motor carrier vehicle section of that jurisdiction and ask to obtain an IFTA license and decals to feature on your vehicle.

How to get ifta sticker in ohio. IFTA licenses may be renewed electronically between October 1st and December 31st each year. License application forms can be found online it differs by each state and are administered by the Department of Transportation for your. If you need to renew your license outside of that period request additiona decals or request replacement decals please contact the.

This allows you to travel in all IFTA member jurisdictions. One decal should be placed on each side of your vehicle. Fill it out the select the renew box.

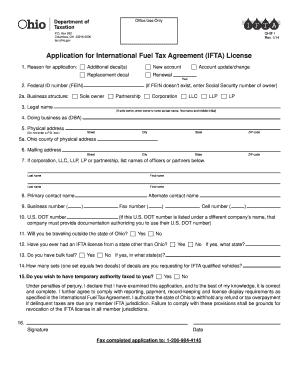

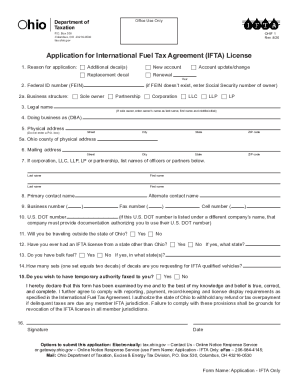

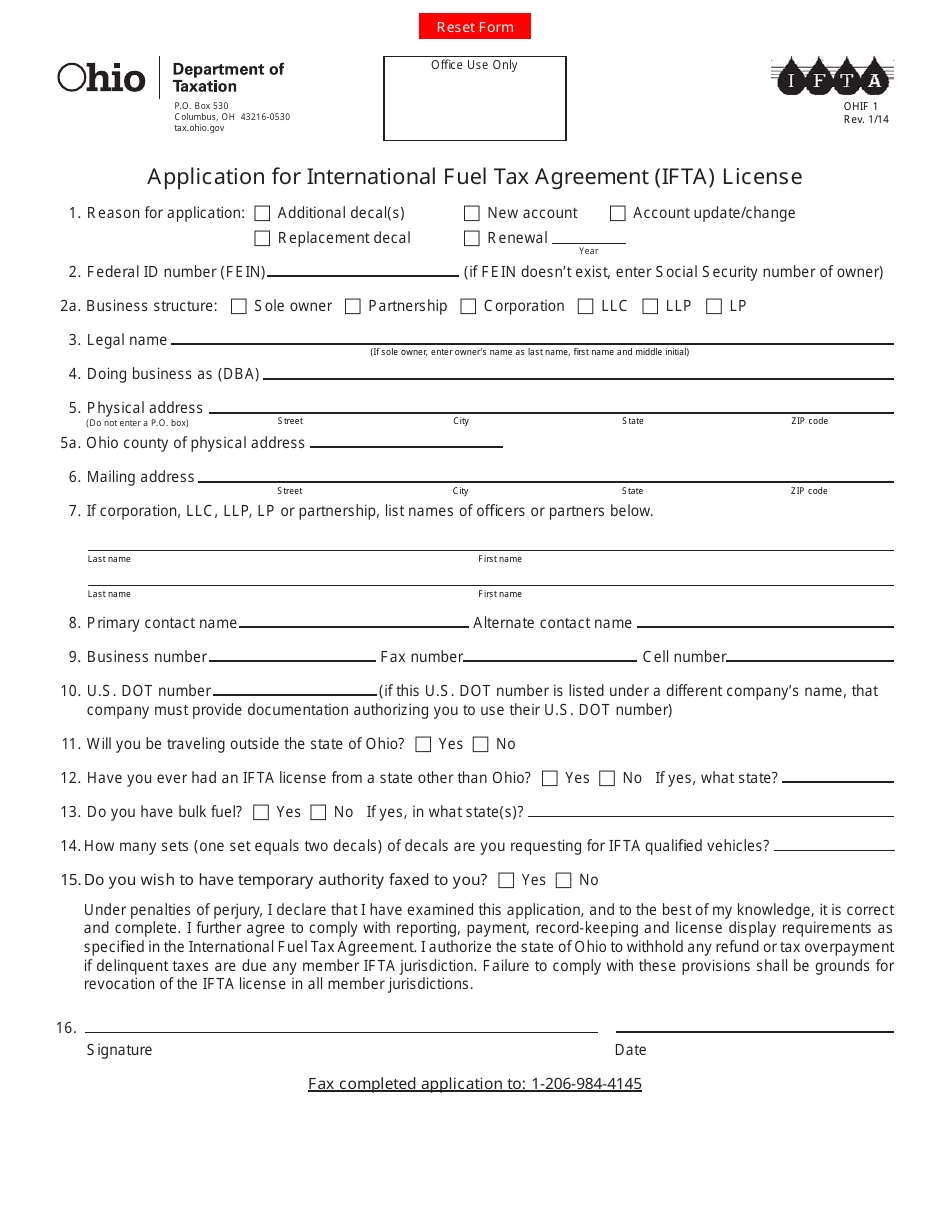

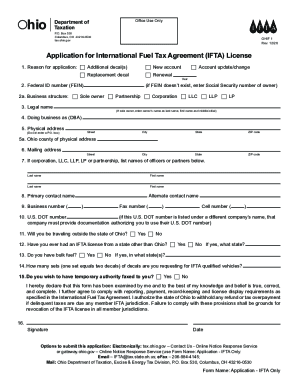

Carriers based in Ohio for example can use the IFTA application form to request additional decals or make changes to their account. International Fuel Tax Agreement IFTA License to the Department. You can also access the service at taxohiogov - Online Notice Response Service utilizing your same Gateway Username and Password.

Mark Yes if you have had an IFTA license from a state other than Ohio and list the states. You may find more information in the MCS Manual. How do I apply for an IFTA license in Ohio.

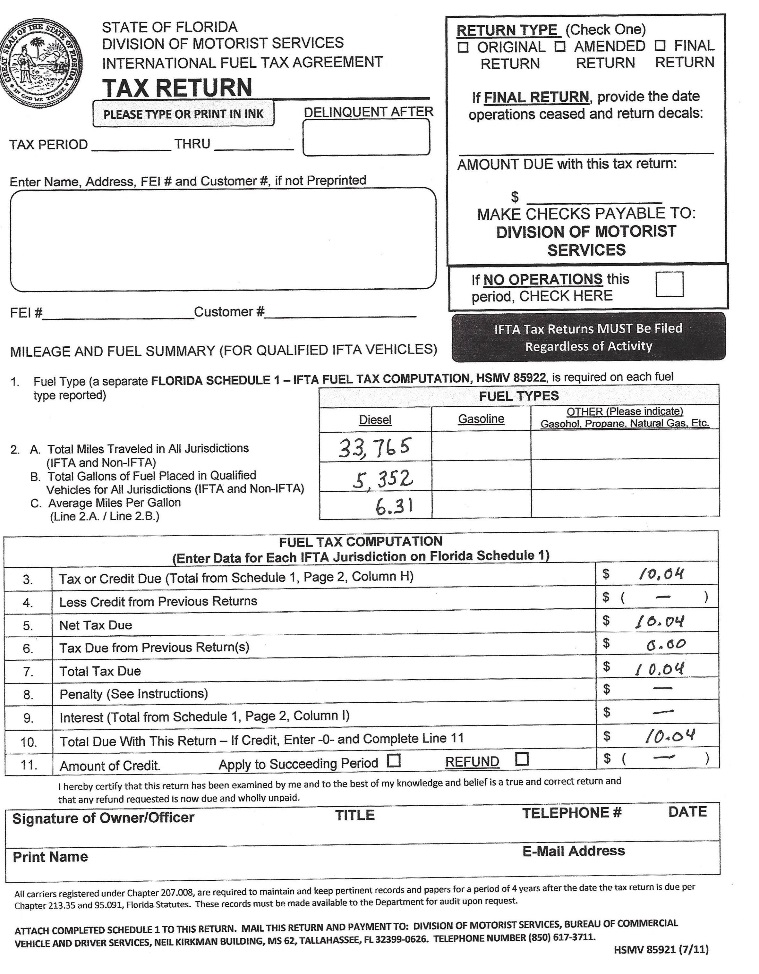

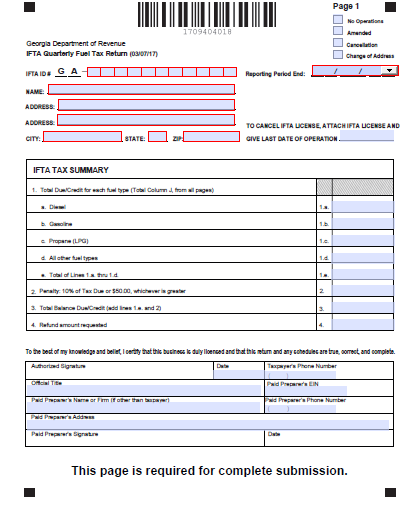

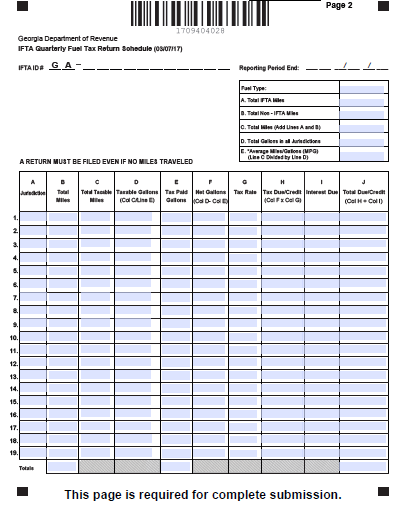

Its time to prepare to file your IFTA International Fuel Tax Agreement if you havent already. You must file an IFTA Decal Application annually to order a set of 2 decals for each qualified vehicle 10 a set. Contact Ohio directly to receive the application form.

You are required to have one set per vehicle. You can either pay the registration invoice at your state IRP department and pick up you plates or mail in a cashiers check or money order to your state IRP department and they will send your plates by mail. If you need an IFTA license the first step is to fill out the application form used in your base state.

Review current requirements and restrictions on the IFTA Inc. IFTA application forms may vary and can sometimes serve other purposes. For buses please place one sticker on each side no further back than the back of the drivers seat at eye level from the ground.

If an IFTA license is needed please complete the Kentucky Trucking Application form TC 95-1. If a temporary decal permit is needed prior to receiving the decals make sure to request this and provide a fax number on the application. Each qualified vehicle is required to post 1 decal on each side of the vehicle.

Obtaining an IFTA license and decals are important steps in becoming a successful owner operator. What IFTA credentials will Ohio give me. To renew your Ohio IFTA License there is a Ohio Department of Taxation Form that can be downloaded here.

If your company requires an IFTA license you need to apply in your base state. The OHIF-1 form can be found at wwwtaxohiogov by selecting the Forms link. The penalties for missing a deadline can amount to 10 of the taxes you owe or 50.

Enter the number of IFTA qualified vehicles for the. If youre new to IFTA the process of calculating your totals. International Fuel Tax Agreement IFTA is a fuel consumption tax as prescribed by KRS 138660 1 2.

Mark Yes if you have bulk fuel tanks and list the states where the tanks are located. International Fuel Tax Agreement IFTA Pursuant to Ohio Executive Order 2020-14D issued by Governor Mike DeWine commercial truck carriers hauling COVID-related emergency supplies do not have to purchase a single trip permit if they are traveling into or through the State of Ohio. All decal requests are processed on the next business day and mailed to the address on file.

Processing will be completed within 24-48. IFTA streamlines paperwork and compliance burdens for reporting fuel tax liability for gasoline diesel propane blended fuels gasohol or. Assuming that you meet the requirements for IFTA you will be issued with the correct license and decals.

If not mark No 13. A copy of the Order must be retained in each commercial. If you will not cross the Ohio border mark No 12.

Decals are valid from January 1 to December 31 per year. You must attach one sticker to each side of the vehicles rear in the lower corner. If not mark No 14.

Applying for an IFTA license and decals. Once complete you should submit it to the regulating body with the requested processing fee. How to obtain an IFTA license and decals.

If an IFTA carrier needs to amend returns they can do so in the new IPC system. Simply click the Upload Document to Ohio Department of Taxation option from your Dashboard to start the process. The International Fuel Tax Agreement IFTA is an agreement among jurisdictions United States and Canadian provinces to simplify the reporting of the fuel use taxes by interstate carriers.

What fees must I pay under IFTA in Ohio. IFTA decals are 3 per set. ELD Requirements for IFTA Compliance.

Depending on your states policies you may also be able to pick up your IFTA decals at the same time your pick up you plates. There is no fee for the Ohio IFTA license and decals. You will need to complete Application for International Fuel Tax Agreement OHIF-1 License and fax to 614 728-8085.

Additional International Fuel Tax Agreement IFTA decals may be ordered by submitting a request through Georgia Tax Center.

Ohio State Ifta Fuel Tax File Ifta Return Online Ifta Tax

International Fuel Tax Agreement Ifta Department Of Taxation

2020 Form Oh Ohif 1 Fill Online Printable Fillable Blank Pdffiller

International Fuel Tax Agreement Ifta Department Of Taxation

Form Ohif1 Download Fillable Pdf Or Fill Online Application For International Fuel Tax Agreement Ifta License Ohio Templateroller

Https Tax Ohio Gov Static Excise International Fuel Tax Agreement Ifta Obg 203 0 20how 20to Ifta 20renewal Pdf

Form Ohif1 Download Fillable Pdf Or Fill Online Application For International Fuel Tax Agreement Ifta License Ohio Templateroller

International Fuel Tax Agreement Ifta Department Of Taxation

Fillable Online Tax Ohio If Fein Doesnt Exist Enter Social Security Number Of Owner Fax Email Print Pdffiller

International Fuel Tax Agreement Instruction Manual Ifta Ohio

International Fuel Tax Agreement Ifta Department Of Taxation

Ohio Ifta Fuel Tax Requirements

Fuel Permits Ifta Permit Temporary Ifta Permits

Index Of Clist Assets Images Copy

Ohio Oh Ifta State Tax Ifta Quarterly Fuel Tax Ifta Online

Fuel Permits Ifta Permit Temporary Ifta Permits

Fuel Permits Ifta Permit Temporary Ifta Permits

International Fuel Tax Agreement Instruction Manual Ifta Ohio

Post a Comment for "How To Get Ifta Sticker In Ohio"